Internet Banking

PASHA Bank offers its customers Internet Banking services based on modern technologies. Internet Banking enables the customers to use number of bank services remotely via banking services technologies without visiting the bank.

Advantages of the service

- 24/7 availability from anywhere in the world.

- Ability to start transactions from any computer through logging in with the special key offered to authorized staff.

- Reduced work load of company employees, elimination of time consuming visits to the bank which leads to convenience and satisfaction of the employees

- This service does not require special hardware and software.

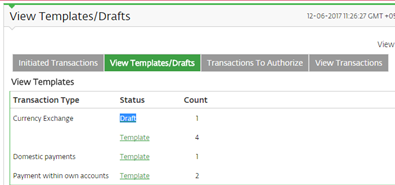

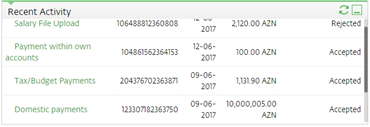

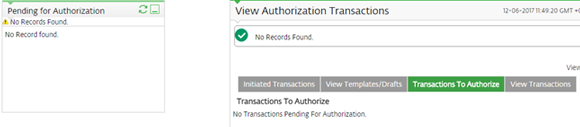

Operations

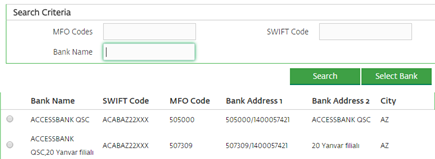

- Local payments - Payments within the Republic of Azerbaijan

- International payments - payments with foreign currency outside the country

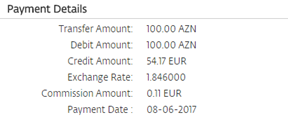

- Conversion operations - purchase and sales of foreign currency

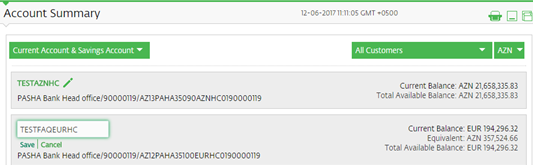

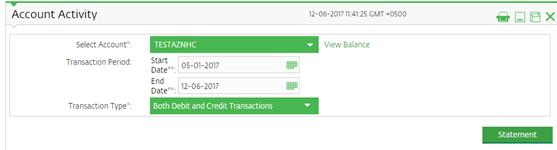

- Account statements - obtaining statements for any period

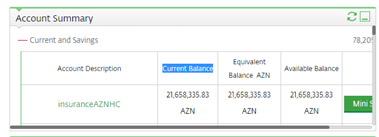

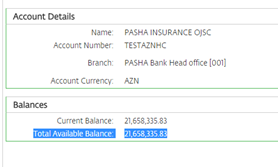

- Account balance - information about the balance in the account

- Information about card balance

- Information about loans

- Information about deposits

- Information about currency exchange fees

Signing up for the service

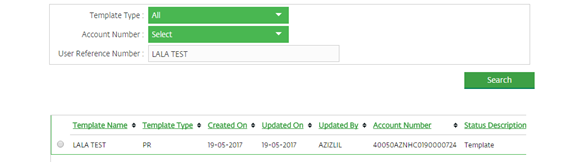

The customer shall receive Login and Password for Internet Banking System upon signing the relevant documents for Internet Banking services in PASHA Bank Business Centers. Bank personnel will provide briefing and full consultation support for company employees on usage of Internet Banking services.

Customers signed up for Internet Banking service can login into the Internet Banking System 24/7 via the following link.